Author: Irina

Everything about cash withdrawals abroad - we compare banks, talk about our experience from 30 countries + tips on how to secure your card from fraudsters.

The most card-friendly place we've been to is Prague. There you can even leave a tip to the waiter from the card :) And in Paris I ran to the nearest ATM, because the crème brлеlée was already eaten, and then suddenly - cash only, sorry. In a stressful situation, of course, there is no time for commissions. Therefore, it is always best:

1) have some cash in stock

2) and a bank card, from which you can withdraw money with the maximum benefit for yourself.

Do not be afraid to use several bank cards: somewhere you can get free insurance, somewhere - a good cashback, and somewhere - free cash withdrawal. |

Cards with cash withdrawal abroad without commission

On the Russian market of banking services, there are quite a few proposals to issue a card by which cash withdrawals abroad are carried out without commission.

In stores, we try to pay by credit card

(pre-set limits in the application)

IMPORTANT! In all cases it is meant that there is no commission from the bank that issued the card... A foreign ATM can also write off money - for use. If you want to avoid this, carefully read the inscriptions on the screen - as a rule, they warn about this.

Most Popular debit maps for travelers:

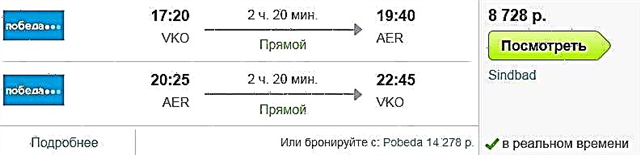

| Map | Conditions for withdrawal without commission | Service cost |

| Tinkoff black from Tinkoff bank | • from 3000 rubles - from a ruble account • from € / $ 100 - from a foreign currency account Limit: up to 100,000 rubles per month; up to € / $ 5000 per month | A card with free service while maintaining a balance of at least 30,000 rubles or 99 rubles per month Multicurrency |

| The choice of ours and of many tourists. If you don't want to read further, here is the conclusion: nothing has been invented better than this card for withdrawing cash. | ||

| Opencard from the bank Opening | • always commission-free Limit: up to 200,000 rubles per day / 1,000,000 rubles per month up to € 2,500 per day / € 13,000 per month up to $ 3000 per day / $ 15,000 per month | Is free Multicurrency |

| Travel benefits from Home Credit bank | • the first 5 transactions per month - no commission, then 100 rubles for withdrawal Limit: up to 500,000 rubles per day | Free of charge for daily maintenance of the balance OR for spending a month in the Russian Federation, except for travel, at least 30,000 rubles or 199 rubles per month Not multicurrency |

| Multicard from VTB Bank | • when spending more than 75,000 rubles per month Limit: 350,000 rubles per day 2,000,000 rubles per month | Free when spending from 5000 rubles per month or 249 rubles per month Multicurrency |

| Alfa Travel from Alfa Bank | • the first 2 months of service • further, provided that the balance is maintained at least 30,000 rubles OR spending per month at least 10,000 rubles | Free if you maintain a balance of 30,000 rubles or more or if you spend at least 10,000 rubles per month or 100 rubles per month Multicurrency |

| CitiOne + from Citibank | • at Citibank ATMs abroad • while maintaining 300,000 rubles on the card OR spending more than 30,000 rubles per month Limit: up to 300,000 rubles per day / 2,000,000 rubles per month | Free if there are 300,000 rubles on the account or monthly expenses on the card from 30,000 rubles or 300 rubles per month Multicurrency |

So, so, what if you go abroad with a classic Sberbank card? The commission cannot be avoided in any case: 1% of the withdrawn amount, but not less than 100 rubles (and if from a euro / dollar account, then not less than € / $ 3). According to the Sberbank limit: 150,000 rubles per day, or $ 6,000, or € 4,500.

Usually, a salary card of any Russian bank is unprofitable for traveling abroad. "Concessions" for cash withdrawals are usually given either to premium card lines (the conditions of which are transcendental for free), or to travel cards. But there are also nice banks that do not chase an extra ruble from a client and provide free cash withdrawal at foreign ATMs. All of them (+ travel) are in the table. We ourselves have been using Tinkoff Black for a long time.

In addition to the commission, there is another financial nuance - this terrible word "conversion".

How does the conversion from the card work?

We withdraw cash from ATMs in Marrakesh

We read carefully.

Conversion is nothing more than the translation of one currency into another. Look, we come to an ATM in some Spain and want to withdraw 100 euros from the Tinkoff ruble card *. What's happening?

* below I will explain why exactly Tinkoff

EUR-RUB

| Foreign bank makes a request to the payment system (€ 100) | → | Payment system (Visa, MasterCard) sends a request to your bank | → | The card bank converts € 100 into rubles at its own rate (and it is individual and differs from the Central Bank) | → | ATM dispenses cash € 100 |

And if rare money is involved in the chain, for example, is it necessary to withdraw 100 lira from the ruble Tinkoff * in Turkey? Since the payment system (Visa, MasterCard) always sends a request to your bank only in euros or dollars, then:

LOCAL CURRENCY — USD — RUB

| A foreign bank makes a request to the payment system in local currency (100 liras) | → | Payment system (Visa, MasterCard) converts 100 lira into dollars at its own rate | → | Payment system (Visa, MasterCard) sends a request in dollars to your bank | → | The card bank converts dollars into rubles at its own rate | → | ATM dispenses 100 liras in cash |

* another plus for the Tinkoff Black card: Tinkoff is an advanced bank, and in the euro zone it works with a payment system in euros, and in the dollar zone and any other currency - in dollars. Sberbank is still capable of boasting such versatility and ... that's it. The rest of the banks have a clear reference to the dollar or euro in their work with payment systems (this should be found out at the bank). With them, the withdrawal of 100 euros in Europe may threaten with a double conversion (as in scheme # 2).

Long term and frequent travel you can get even more confused. Reduce the number of conversions to a minimum (ideally 0 or 1). To do this, you need to open an account in dollars or euros. And even better - both in dollars and euros. After all, then:

- Column 3 will drop out of scheme # 1 (no conversion!),

- and from scheme no. 2, column no. 4 will disappear (conversion 1 time, instead of 2).

That is why a multicurrency bank card is a godsend for travelers. The table above shows which banks have this option. For my ruble Tinkoff Black, I added $ and € invoices in 5 minutes: I went into the mobile application, poked buttons, waited for confirmation and bought currency. On trips, the required account is instantly linked to the card after the simplest online manipulations in the application.

Course when paying by card - where is it more profitable?

We've tried a bunch of different banks over the years

some of them just didn't fit here :)

Payment by card abroad is carried out according to the same schemes as cash withdrawal. Only here a cross-border payment can sneak up, and losses from conversion can be compensated by cashback.

If many processes of how funds are debited from a card remain too confusing for you, then - peace of mind! - here is the painstakingly collected and verified information.

Which cards have the best rate?

The transfer of rubles into the currency that you use to pay abroad consists of several components: the rate of the Central Bank +% from above for conversion +% for a cross-border payment (possible, but not for all).

You can "beat off" the interest with a cashback (let's take the basic one), if the card has one.

- Tinkoff Black = Central Bank rate + 2% (conversion) + 0% (transgran)

Cashback: 1% for everything - Opencard: Central Bank + 3% (conversion) + 0% (transgran)

Cashback: 3% for everything - Travel benefit: Central Bank + 2% (conversion) + 0% (transgran)

Cashback: 3% on any purchases abroad - Alfa Travel: Central Bank + 1.5% (conversion) + 1% (transgran)

Cashback: 2-3% for everything - VTB multicard: Central Bank + 2.5% (conversion) + 0% (transgran)

Cashback: 1-4% for everything

In more detail about which bank has a higher percentage of the balance, the cashback for tickets / hotels is steeper and the priority pass is more profitable, we wrote in another article - the best bank cards for travel.

Our experience with cash withdrawals abroad

In Belgrade (Serbia), we withdrawn money from a Sberbank ATM at the airport

To withdraw cash abroad, we use 1 main card - Tinkoff Black - and the ruble, dollar and euro accounts linked to it. In Europe, we withdraw euros from the € account without conversion, in the USA - dollars from the $ account also without conversion, but in other countries - the local currency from the $ account with a one-time conversion.

There are usually no special difficulties. We translate the ATM into English mode, carefully read the inscriptions on the screen. If the terminal reports a commission (its own, Tinkoff does not have it for withdrawals from € / $ 100), if possible, look for another. If you need money urgently, we will additionally fork out an average of $ 3-4. At the airport in Budapest, for example, this. And in Thailand.

A Sberbank card abroad, by the way, is sometimes also useful: if there are branches in the country where you are heading. Withdrawals from native ATMs are free of interest. We saw them in Belgrade, Budapest, Prague. Sberovskiy exchange rate abroad differs from the Central Bank, approximately + 2%. But it's better to make sure in advance that the terminal fits into your route. Usually in the city there are no more than 1-2 places with Sberbank, and the commission for withdrawing cash abroad from the bank is 1%.

How to secure your money abroad?

In addition to a few bank cards, we always try to take cash with us

Hint: back in 2008, we, students, went to the USA under the Work & Travel program for the summer. The currency for the first weeks of life was bought in advance at Sberbank, at the cash desk, according to a passport. They drove, shoving, on the advice of their parents, in 5 different places (in underwear, including)). Glory to progress, in 2021 there is no need to resort to such tricks. But still!

- Before the trip, warn your bank about the trip so that at the most inopportune moment your funds on the card are not blocked due to a "suspicious" transaction abroad. There are many places where this can be done through the application. Comfortable!

— Set limits on cash withdrawals and purchases. Tinkoff, Sberbank, Alpha have a similar service. Several times, the $ 100 limit saved us on trips to the United States and Bali - which, in our experience, turned out to be the most "criminal" in matters with cards. Skimmers tried to write off large sums, but the limits were firmly on the guard of our funds.

- You can temporarily block the card if it is used only occasionally (for paying for hotels and air tickets, for example). Again, if the application allows it, it's not the same to call the bank.

* By the way, here I also have something to say about Tinkoff. Somehow in the USA I forgot to set the limit and ... the subscription to Uber withdrew $ 400 from the card (like that, I didn't cancel it in time). I wrote to the manager in an online chat, the card was immediately blocked. But I understand that these are not scammers, and I need a card here and now. To unlock, a call is required, and I was already prepared for frantic roaming, as the manager suggested that you can call in the application via Wi-Fi without spending a ruble.

- Good old advice from the 2000s is also still relevant: block the keyboard when entering a PIN, do not keep all your money in one place, do not withdraw cash from an ATM at night in questionable areas with a bad reputation.

What restrictions can there be? Our Tips

This is what the local currency (dinars) looks like in Serbia

Withdrawing cash abroad: how much is the maximum? We usually manage with amounts of $ 100-200, maximum $ 500 at a time, but there are different requests and situations.

- Tinkoff Black: individually for each client, you can find out through the application (the maximum maximum is 1,000,000 rubles at Tinkoff ATMs)

- Opencard: daily limit - 200,000 rubles / $ 3,000 / € 2,500

- Travel benefit: daily limit - up to 500,000 rubles

- Alfa Travel: daily limit - 300,000 rubles

- CitiOne +: daily limit - RUB 300,000 (or equivalent in other currencies)

In addition to the limits set by the bank, ATMs can also set a withdrawal limit. This amount is shown on the display during data entry. You can “cheat” the terminal by re-inserting the card and requesting money again.

✓ In some cases, a credit card is very useful - for example, somewhere renting a car without a credit card is impossible. It is also convenient to book hotels with it: if some amount of the deposit is frozen, this will not affect the rest in any way. Of course, the card must be with an interest-free repayment period (on average, from 30 to 50 days).

✓ Get a multicurrency card and buy local currency in advance at a favorable rate. For example, before traveling to Turkey, it makes sense to open an account in lira, transfer rubles into them and pay while traveling / withdraw cash from an ATM abroad from this account for free.

Ps-s, 29 currencies are available in Tinkoff :)

✓ Ensure the safety of your money abroad in advance: limits, bank notification about the trip are a must.

There are quite a few offers on the market now. All debit cards have their pros and cons. The best card for us is Tinkoff Black. Everything with her:

- free withdrawals,

- absence or one-time conversion,

- multicurrency,

- limits,

- modern and advanced mobile application where any issue can be resolved quickly and remotely.

By the way, we recently upgraded Tinkoff Black to premium Tinkoff Black Metal - and it got even better. Read the review here! - Free service under real conditions.

But here everyone chooses for themselves. My parents, for example, are morally very scared to switch to Tinkoff, because if something goes wrong, the aunt does not exist in the window. Who should I go to swear to? Someone has 1,000,000 rubles, which they safely keep on a premium card and use in honor of this commission-free cash withdrawal + business lounges at airports.

If we talk about what the average tourist can use with maximum efficiency, of the simple options, the most versatile and profitable card, in our opinion, is Tinkoff Black.